Tuesday, January 7, 2025

Pre-Market Futures Climb Higher

The pre-market futures are gaining momentum this morning, following a strong day on the tech-heavy Nasdaq but remaining flat on the Dow and S&P 500. At present, it’s the blue-chip Dow that has the edge, with a +120 points increase, while the S&P is up by +13 points, and the Nasdaq is climbing at a rate of +18 points. The small-cap Russell 2000 is also making gains, currently sitting at +7 points.

NVIDIA Up Following CES Keynote

NVIDIA Corporation (NVDA)

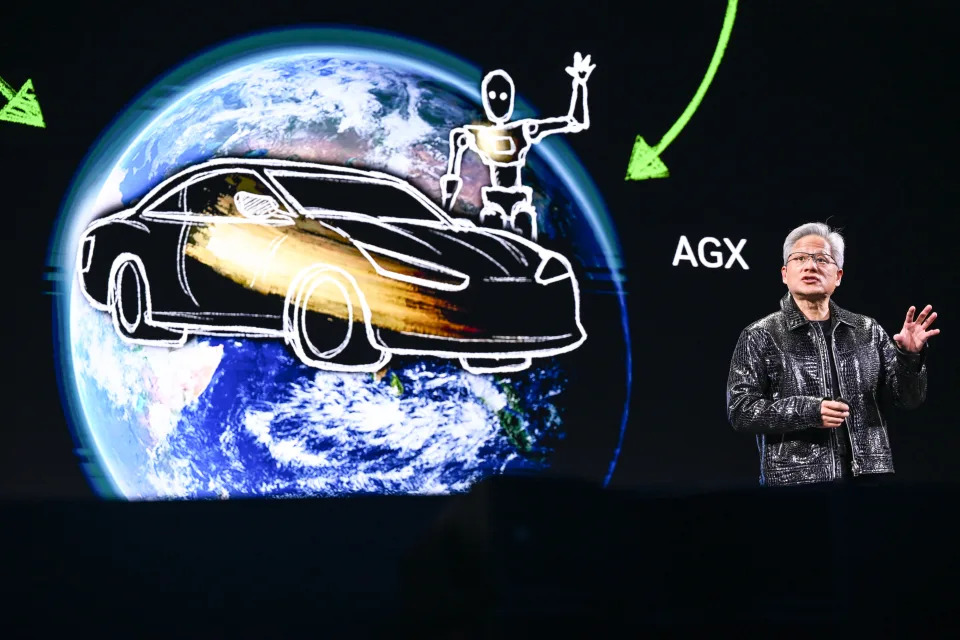

CEO Jensen Huang delivered the keynote address at the Consumer Electronics Show (CES) in Las Vegas on Monday evening, bringing with him moderately exciting news about his company’s new offerings. Clad in a shiny black Tom Ford lizard-skin motorcycle jacket, Huang presented unveilings in several key areas.

Among these is NVIDIA’s new graphics card for gaming – the GeForce RTX 5090, designed for desktop PCs – alongside a smaller AI chip: GB10, a stripped-down version of its GB200. Huang explained that the rest of the Mag 7 companies are gobbling up this technology. He also spoke about their new Cosmos platform, which will be used for training robots and self-driving cars.

Time will tell if this address will spark another big move into NVDA stock. A year ago, NVIDIA shares gained roughly +90% over the 10 weeks following the 2024 CES. Currently, Huang’s company is up by +2% ahead of today’s opening bell. It has once again become the world’s largest company in terms of market cap, surpassing Apple (AAPL) for a second time.

November Trade Deficit Basically In-Line

The U.S. Trade Balance (a deficit that has been prevalent over the past several decades) for November was released this morning, coming in at -$78.2 billion. This represents a deep cut, but not quite as deep as the -$78.4 billion expected. This follows the slightly improved revision to -$73.6 billion from the previous month. The deficit is currently the deepest since September of last year but still off the all-time low of -$101.9 billion in March 2022.

What to Expect for Tuesday’s Stock Market

Later this morning, after the opening bell, we’ll see two new and fairly important economic metrics: ISM Services for December and Job Openings and Labor Turnover Survey (JOLTS) for November. The former follows Monday’s S&P Services PMI, which came in lighter than expected but still well above the 50-level, representing growth versus contraction. The latter kicks off what we call ‘Jobs Week’.

ISM Services

The ISM Services for last month is expected to grow slightly to +53.4% from +52.1% reported in November. We’re once again above the 50% threshold, indicating growth in the Services sector – as seen in labor market prints over the past year or more – which has been driving the U.S.’ strong economy.

JOLTS

The JOLTS data is expected to remain steady at 7.7 million job openings for November. We’ve been in a range of JOLTS headlines for the past several months, and while a move notably higher or lower would constitute something of a surprise, one month’s worth of data would not likely do much to move the needle on, say, the Fed’s decision to lower interest rates at the end of this month (currently looking like there will be no move in January 31st).

Questions or Comments?

If you have any questions or comments about this article and/or author, click here.

Want the Latest Recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Recommended Stories

- Apple Inc. (AAPL) : Free Stock Analysis Report

- NVIDIA Corporation (NVDA) : Free Stock Analysis Report

- Invesco QQQ (QQQ): ETF Research Reports

- SPDR S&P 500 ETF (SPY): ETF Research Reports

- SPDR Dow Jones Industrial Average ETF (DIA): ETF Research Reports

Read This Article on Zacks.com

To read this article on Zacks.com, click here.

View Comments

Comments are currently closed.