The Problem with Traditional Banking Solutions for Non-Profits

Traditional banking solutions often fail to meet the unique needs of non-profit organizations, such as fraternities, sororities, booster clubs, and other member-based groups. These institutions typically require specialized features that cater to their distinct requirements. Crowded, a free banking app designed specifically for these organizations, has closed $6 million in funding to continue developing its suite of banking and member management tools.

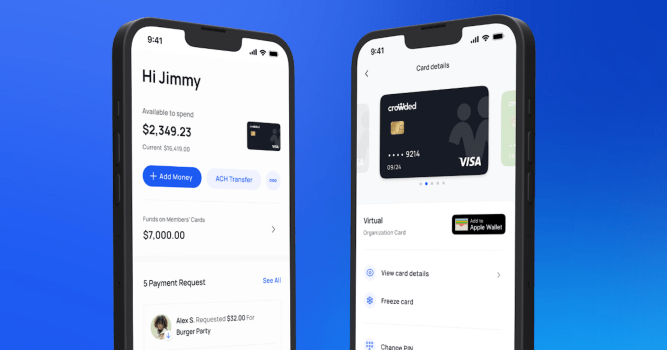

Crowded’s Solution

The company’s co-founder and CEO, Daniel Grunstein, explained that Crowded was created to address the shortcomings of traditional banking solutions for non-profit organizations. He noted that many of these groups often open banking accounts at nearby institutions but lack access to modern features such as digital member management tools.

"We designed our mobile app specifically for club treasurers so they can perform duties like requesting and collecting member dues and tax reporting digitally, rather than physically sending out notices each month," Grunstein stated.

Entering a Crowded Market

Crowded is entering a somewhat crowded space in the organization management market. For instance, Heylo raised $1.5 million in seed funding this year for its member coordination app, while OurHouse and OmegaFi specifically target fraternities and sororities. However, Grunstein believes that Crowded’s unique approach sets it apart from its competitors.

Key Features and Revenue Model

Crowded offers both physical and virtual debit cards for its members but allows organizations to link their existing bank accounts as well. One of the key differentiators is the company’s revenue model, which collects interchange fees from merchants when its debit cards are used to make purchases. Additionally, Crowded charges processing fees for member payments at around 3% or $5 per payment, which Grunstein claims is lower than the industry average of 8%.

Founding Team and Growth

Grunstein started Crowded with co-founders Dvir Hanum, Darryl Gecelter, and Dor Kleinmann in June 2021. The founders bring a background in either financial technology or alumni network tech. Grunstein himself has experience in fintech and enterprise software, having previously worked with JP Morgan Chase.

Since launching a year ago with five customers, Crowded has grown to 300 chapter customers using the platform. Additionally, the company has signed letters of intent with another 1,200 chapters.

Seed Round Funding

The seed round was led by Garage and included Deel co-founder Philippe Bouaziz, Innoventure Partners’ Michael Marks, and a group of former bank executives. The new funding will be deployed into building out the platform, marketing, and compliance as it pertains to nonprofit finances.

"We are working on completing the build of features so that what our customers do at a regular bank they can do with us," Grunstein explained. "We also want to add a self-service component, get into new markets, continue to grow in colleges, and diversify our customer base."

Future Plans

Grunstein expressed confidence in Crowded’s growth trajectory, stating that the company is on its way to achieving $1 million annual recurring revenue. The team plans to use the seed funding to complete the development of features and expand into new markets.

"If we can meet those milestones, we will plan to do a Series A next year," Grunstein said.

Conclusion

Crowded’s innovative approach to banking and member management tools for non-profit organizations has garnered significant attention in the industry. With $6 million in funding, the company is well-positioned to continue building out its platform and expanding into new markets. As Crowded continues to grow, it will be interesting to see how the company differentiates itself from competitors in a crowded market.

About Crowded

Crowded is a free banking app designed specifically for non-profit organizations such as fraternities, sororities, booster clubs, and other member-based groups. The company’s mission is to provide specialized features that cater to the unique needs of these institutions.

Key Takeaways

- Crowded raised $6 million in funding to develop its suite of banking and member management tools for non-profit organizations.

- The company’s revenue model collects interchange fees from merchants when its debit cards are used to make purchases.

- Crowded charges processing fees for member payments at around 3% or $5 per payment, which is lower than the industry average of 8%.

- The company has grown to 300 chapter customers using the platform and signed letters of intent with another 1,200 chapters.

Related Stories

- Apple brings Store app to Indian market

- Failed fintech startup Bench racked up over $65 million in debt, documents reveal

- AI: Apple pauses AI notification summaries for news after generating false alerts