The late-stage market has been facing significant challenges, with many venture firms struggling to raise capital. Recently, Insight Partners reduced its fundraising target from $20 billion to $15 billion, having already raised a measly $2 billion of the pot. However, this development should not be taken as a sign that the entire fundraising market is in trouble.

Insight’s Reduced Target: A Cautionary Tale

While some may view Insight’s decision to reduce its target as a warning sign for the industry, it’s essential to understand the context behind this move. As Kyle Stanford, senior venture analyst at PitchBook, pointed out, "Obviously Insight and TCV, they invest in the hardest part of the market to invest in at the moment — late-stage venture, growth-stage companies that should be IPO-ing." It’s not surprising, therefore, that these firms are struggling to raise capital.

Insight Partners’ decision to reduce its target is also a strategic move to ensure that the firm can deploy its funds effectively. If it were to raise the full $20 billion and the late-stage market didn’t improve significantly over the next year or so, the firm would be forced to invest in a large portion of all late-stage deals during their investment period. This would compromise the quality of investments, making it challenging for Insight Partners to achieve its objectives.

The Late-Stage Market: A Tough Climate

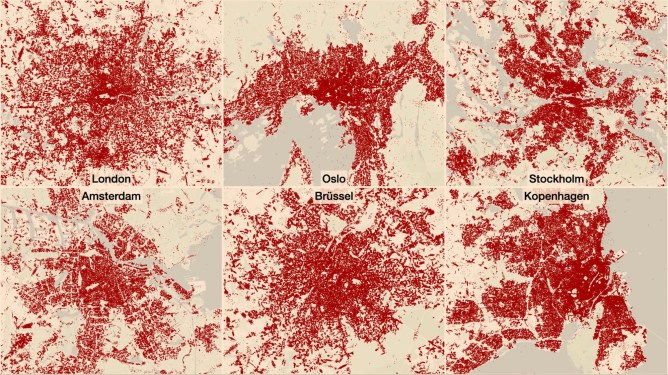

The data speaks volumes about the state of the late-stage market. According to PitchBook, only $11.3 billion was invested in late-stage companies in the first quarter of this year, which is the lowest quarterly total since the fourth quarter of 2017. This decline underscores the challenges facing venture firms that focus on late-stage investments.

Other Firms Feeling the Pinch

Insight Partners is not alone in its struggles to raise capital. TCV reportedly ended up raising only 55% to 75% of its $5.5 billion target for its fund last year, while Founders Fund reduced its target from $2.5 billion to $1.5 billion. These developments highlight the difficulties faced by venture firms that focus on late-stage investments.

A Closer Look at LPs

While it’s true that some large limited partners (LPs) have adjusted their investment strategies, this should not be taken as a sign of reduced interest in venture capital. In fact, several deep-pocketed institutional LPs have expressed their desire to invest more in venture capital.

CalPERS and Connecticut State Retirement and Trust Funds: A Growing Appetite for Venture Capital

CalPERS has stated that it wants to broaden its venture portfolios, while the Connecticut State Retirement and Trust Funds is considering setting up a new partnership with a fund of funds to commit $300 million to new venture opportunities. These developments demonstrate that LPs are still interested in investing in venture capital.

New Commitments: A Signal of Confidence

Recent commitments from institutional LPs, such as New Mexico State Investment Council backing Lux Capital’s fund and making its first commitment to Wing VC, show that these investors remain confident in the potential for venture capital returns.

Conclusion

The late-stage market is facing significant challenges, but this should not be taken as a sign of reduced interest in venture capital. While some firms are adjusting their strategies, LPs continue to demonstrate confidence in the sector. As the industry navigates these choppy waters, it’s essential to separate fact from fiction and understand the nuances of the fundraising landscape.

Topics Covered:

- Late-stage market challenges

- Insight Partners’ reduced target

- LPs adjusting investment strategies

- Continued interest in venture capital

Relevant Articles:

- "Timekettle’s new earbuds offer real-time translation on calls" by Brian Heater (3 hours ago)

- "Accel could raise billions for India, but it’s sticking to $650 million" by Manish Singh (3 hours ago)

- "What will this year bring in VC? We asked a few investors" by Dominic-Madori Davis (1 day ago)

Stay Up-to-Date with the Latest Venture Capital News

Subscribe to TechCrunch’s newsletters, including TechCrunch Daily News, TechCrunch AI, and Startups Weekly, to stay informed about the latest developments in venture capital.