A week of earnings from lower-cost food and beverage retailers underscored a market reality: many consumers are feeling the pinch of inflation and ongoing economic uncertainty. The results from McDonald’s and Starbucks pointed to meaningful domestic sales pressure in the United States during the first quarter, highlighting how consumer budgets are tightening even as people still seek affordable dining options. Executives from both chains framed the weakness in the broader context of tariff concerns, mounting inflation, and a growing tendency for households to shift toward at-home consumption. The pattern aligns with broader signals about consumer sentiment and purchasing behavior, particularly among lower-income segments that are most exposed to higher everyday costs.

McDonald’s and Starbucks: Early Signals from Two Price-Sensitive Sectors

U.S. Domestic Sales Decline and Its Causes

In the latest quarterly reporting cycle, McDonald’s recorded a notable erosion in its U.S. same-store sales, with a contraction of 3.6% in the first quarter. The slide was driven by a decline in customer visits, i.e., a drop in the guest count, marking the steepest drop in the metric since 2020. This development places McDonald’s among the few familiar fast-food chains showing a meaningful domestic traffic downturn at a time when broader consumer spending is being recalibrated. The magnitude of the decline signals that even brands built on affordability can experience demand normalization as households scrutinize every expenditure component.

Starbucks, positioned in a different but related segment of the market, faced its own set of domestic headwinds. The coffee giant reported a 4% year-over-year decline in revenues from U.S. stores within the quarter, reinforcing the narrative that inflation and macro pressure are not confined to premium or discretionary formats. The juxtaposition of McDonald’s and Starbucks underscores a common thread in the sector: economic headwinds are manifesting in weaker foot traffic and softer same-store performance, even as both brands maintain strategic importance in consumer wallets.

Tariffs, Inflation, and the Home-Centric Shift in Consumption

Executives from both companies articulated a similar backdrop of economic strain. They cited tariff-related concerns as a factor that injects uncertainty into consumer wallets, potentially dampening discretionary spending. Beyond tariffs, persistent inflation has been translating into more conservative consumer habits, including a greater reliance on cooking at home or opting for lower-cost alternatives rather than premium or more expensive offerings. The shared view across leadership teams emphasizes that inflation is not merely a headline statistic; it translates into tangible changes in shopping and dining behavior, particularly among households with tighter budgets.

This dynamic has intensified a long-standing theme: inflation is shaping how consumers allocate their budgets across essential and non-essential categories. In the context of the restaurant and fast-food space, the inclination to conserve spend translates into more selective visits, choices that prioritize value, and a heightened sensitivity to price—and this is precisely the line of concern that management teams are flagging to investors and analysts.

The Consumer Segments Most Affected

A recurring thread in the commentary is that lower-income customers bear the brunt of cost-of-living pressures. When inflation squeezes real incomes, this segment tends to adjust its purchasing patterns more aggressively—opting for smaller portion sizes, seeking cheaper menu items, or reducing frequency of visits. Both McDonald’s and Starbucks acknowledged that these households have become a focal point in the current environment, and the sustainability of any recovery in their spending hinges on broader inflation trends and wage dynamics. The emphasis on income-stratified sensitivity adds nuance to the earnings narrative: not all consumer groups are reacting to price increases in the same way, and the resilience of an economic recovery may depend on how effectively these households regain confidence and discretionary flexibility.

Pricing Power, Consumer Sentiment, and Market Takeaways

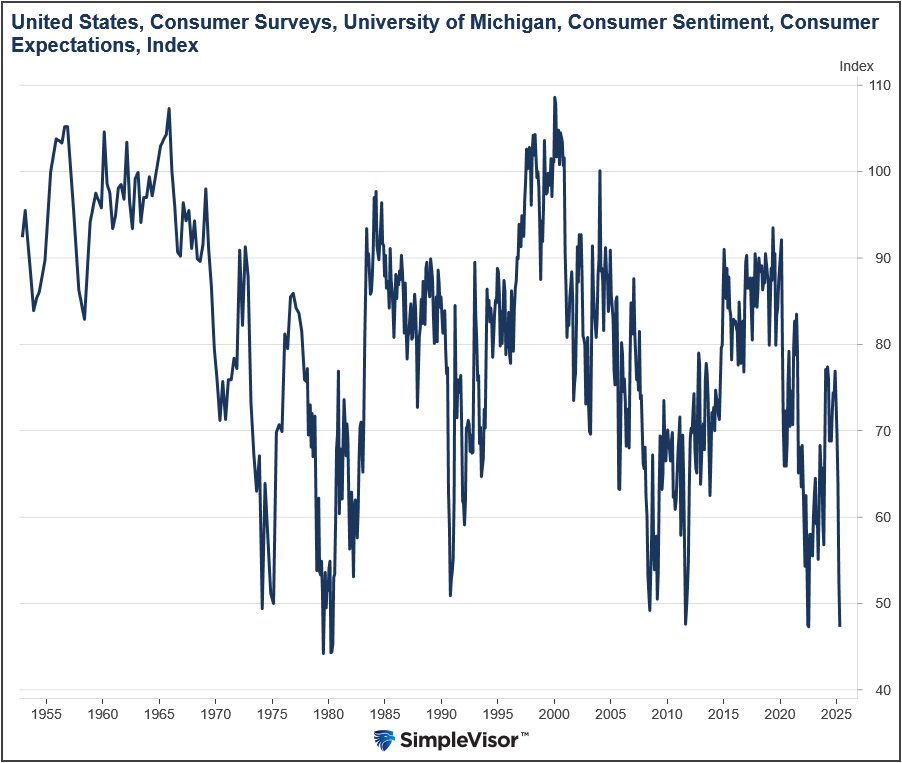

Two essential takeaways emerged from the reports of McDonald’s, Starbucks, and other lower-price retailers this quarter. First, there is an apparent challenge in passing higher costs through to customers. When input costs rise, retailers this size appear constrained in their ability to raise prices without triggering demand erosion, especially in a climate where customers are watching every dollar. Second, poor consumer sentiment, as reflected in cautious spending behavior, is weighing on personal consumption more broadly. These dynamics suggest that while price discipline and value propositions remain critical, macro sentiment and confidence play a decisive role in how quickly a rebound in traffic and transactions may occur.

A Related Perspective from Chipotle

Additional color came from Chipotle’s experience during the period, where the company observed a 0.4% decline in same-store sales, marking its first dip since 2020. Management noted that, as of February, a noticeable rise in consumer uncertainty was already influencing spending patterns. The company’s visitor data suggested that households were prioritizing savings due to concerns about the economy, which in turn reduced the frequency of restaurant visits. This anecdote from another fast-casual operator reinforces the broader narrative that consumer caution is seeping into dining-out behavior, even for brands that have historically benefited from value-conscious positioning.

Integrating the Takeaways into a Broader Picture

Taken together, the earnings signals from McDonald’s, Starbucks, and peers paint a coherent picture of a consumer landscape undergoing a recalibration. The combination of limited pricing power in the near term and persistently cautious sentiment implies a softer path for personal consumption in the near term, even as some segments remain resilient due to value offerings and ongoing demand for convenient dining options. Investors and market observers are left with a more nuanced view of the macro backdrop: macroeconomic uncertainty, inflation dynamics, and tariff-related risk factors are not receding quickly, and the reactions of consumer segments will continue to shape quarterly trajectories for both value-focused retailers and broader restaurant chains.

Market Trading Update: The Technical and Tactical Landscape

Oil Prices, Inflation, and the Growth Outlook

Turning to the market environment, recent movements in oil prices have continued to influence inflation expectations and the broader economic outlook. The trajectory of energy costs remains a central variable in how households allocate budgets, and it also shapes the profitability calculus for consumer-facing businesses. In a year where economic growth remains a topic of debate, energy price trends add a layer of volatility to the inflation narrative and risk assessments across asset classes. Traders and analysts watch oil markets closely for any signs that energy costs will reaccelerate or ease, which in turn would affect consumer sentiment, disposable income, and corporate margins.

The S&P 500 and Moving-Average Dynamics

From a technical perspective, the equity market has shown a recent burst of enthusiasm, with the S&P 500 riding an eight-day streak of gains prior to a fresh leg of trading. The index’s price action has managed to push above a key moving average, signaling a potential shift in near-term momentum. The 50-day moving average has been a focal point for traders, acting as a reference level around which the market has recently found support. Analysts also noted that the 200-day moving average lies ahead as an important longer-term benchmark, with the 100-day average currently positioned above the 50-day mark. This arrangement—where shorter-term averages are aligned above longer-term averages—offers a degree of bullish bias in the immediate horizon, but participants remain mindful of potential reversals.

Support, Resistance, and Short-Term Risk Control

From a technical standpoint, the market previously observed a resistance level formed after the pre-tariff lows—this threshold has now been recast into support, suggesting that a measure of technical resilience has reemerged. In practical terms, a near-term correction would likely find a foothold first at the 50-DMA and then at the prior support basins. However, a break below these levels would violate the recent uptrend and could imply a re-test of lower prices. The near-term outlook thus hinges on how the market interactions with these technical levels unfold, as well as how macro data, corporate earnings, and inflation signals align.

Hedge Positioning and Cash Allocation

Given the mixed signals in the near term and the risk of a renewed pullback, a cautious stance remains appropriate for investors. A recent decision involved increasing a short S&P 500 hedge position and maintaining higher cash levels. The rationale centers on capital preservation and volatility reduction rather than chasing aggressive gains in a potentially capricious market environment. The strategy emphasizes resilience and risk management: if the bullish trend reasserts itself, hedges can be scaled back in favor of equity exposure; if not, cash and hedges can mitigate downside risk. This approach recognizes that markets may not always deliver a clean bottom-timing opportunity, but strategic hedging can offer long-run advantages relative to a pure index-benchmark approach.

The Broader Investment Implication

Overall, the market update reflects a careful calibration of risk in the face of ongoing macro uncertainty. While recent earnings and economic data have contributed to a more constructive near-term tone in equities, investors remain wary of the possibility of further corrections in the coming months. The interplay between energy costs, consumer sentiment, and macro policy will continue to shape the path of stocks, bonds, and alternative assets. The approach of balancing hedges, maintaining liquidity, and staying attentive to moving-average dynamics reflects a disciplined framework designed to navigate a market that can swing on inflation expectations, policy commentary, and earnings surprises.

Labor Market Signals: Jobless Claims and Hiring Trends

Continuing Claims and What They Indicate

In the labor market, continuing jobless claims climbed to 1.916 million, up from 1.841 million in the prior week. This uptick marks the highest level seen since late 2021 and suggests that more job seekers are finding it difficult to secure new employment despite a generally favorable headline job market. The higher level of continuing claims implies that the recovery in labor force participation and job turnover is not translating into a rapid, broad-based reduction of unemployment benefits for a growing share of the unemployed. The data point underscores a labor market that remains dynamic but is not uniformly robust across all segments of the economy.

Initial Claims and Hiring Pace

Initial jobless claims rose to 241,000, above expectations of 223,000 and higher than the prior week’s 222,000. The contrast between initial and continuing claims highlights a nuanced labor picture: while layoffs have not surged en masse, the pace of new job openings and hires has cooled compared with the strongest periods of the expansion. This combination suggests that although the overall unemployment picture may still appear favorable, the underlying momentum for job creation is softer than headline figures might imply. The divergence between initial and continuing claims can be interpreted as a lagging indicator of shifting demand for labor, which has implications for wage growth, consumer spending, and the durability of the economic expansion.

Interpreting the Labor Market Context

The labor market reality, taken together with other macro signals, points to a period of cautious optimism rather than unbridled strength. Low layoffs at present contribute to a sense of stability, yet the weakness in new hiring indicates a potential softening of demand and growth momentum. This combination can influence monetary policy expectations, consumer confidence, and business investment plans. The implication for markets is that investors should monitor labor-market dynamics as a leading indicator of upcoming shifts in inflation, consumer spending, and the broader economic trajectory. The trend toward slower hiring may precede a period of moderation in growth, making prudent risk management and diversification more relevant for portfolios.

China, Gold, and the Dollar Narrative

Reports of Gold Sales: The China Angle

There have been reports suggesting that China sold a substantial quantity of gold, with rumors circulating that tens of millions of ounces moved in a single session. The immediate market response was a drop in gold prices, reflecting a complex interplay of supply-demand dynamics and broader macro narratives. While such reports may carry some informational weight, it is essential to approach them with caution, recognizing that official inventories, strategic asset decisions, and foreign-exchange considerations shape gold flows in nuanced ways. The mere perception of sizeable gold movements can influence sentiment, but it is important to ground conclusions in verifiable data and balanced analysis rather than speculative readings.

Dollar Dynamics and the Gold Narrative

The broader interpretation of large-scale gold activity often intersects with the discussion about the U.S. dollar’s status in the global monetary system. Some observers have speculated that a shift toward greater gold backing or a reduction in dollar reliance could alter long-term investment dynamics. In practice, however, countries with large, liquid foreign exchange reserves—including China—tend to pursue gradual, strategic adjustments rather than radical shifts. The dollar remains deeply embedded in global trade and finance, and any transition would likely unfold over an extended horizon with multiple supporting and offsetting factors. Investors should remain cautious about overreacting to headlines that imply imminent and decisive changes in dollar hegemony or gold-driven policy pivots.

Interpreting Gold Movements in a Complex System

Gold prices often react to a mosaic of influences, including geopolitical developments, inflation expectations, real yields, and central-bank policy signals. While a sudden movement in gold can reflect shifting perceptions about currency stability or risk appetite, it is seldom driven by a single factor. The current episode, in which gold dipped following reports of substantial gold movements, should be interpreted within the broader context of ongoing macro uncertainty, inflation dynamics, and attitudes toward safe-haven assets. As with any asset class affected by macro narratives, the prudent approach is to assess forward-looking implications, balance possible upside against downside risk, and maintain a diversified portfolio strategy.

Investor Sentiment, Strategy, and the Road Ahead

The Interplay of Consumer Behavior and Market Expectations

The earnings snapshots from McDonald’s and Starbucks, along with the market and labor-market signals, underscore a consistent theme: households remain value-conscious amid inflation and policy uncertainty. The degree to which this dynamic persists will shape consumer spending patterns, corporate earnings trajectories, and the pace of economic growth. The sector mix that emphasizes value, affordability, and convenience is likely to remain in focus as households manage budgets and priorities. Investors will continue to weigh macro risks against earnings resilience in a landscape where sentiment can pivot quickly with new data on inflation, wages, and policy developments.

Strategic Positioning in a Cautious Environment

Against this backdrop, strategic positioning that prioritizes risk management, capital preservation, and selective exposure gains relevance. The use of hedges to navigate near-term volatility, as discussed in market updates, reflects a prudent stance in a period where complacency could be costly if conditions shift. A flexible approach that allows for adjusting equity exposure as moving-average signals change can help investors adapt to evolving market dynamics. In a broader sense, the environment favors a diversified framework that can weather inflation surprises, policy changes, and shifts in consumer demand across different sectors.

The Path Forward: Monitoring Key Indicators

As the quarter unfolds, several indicators will remain critical for refining outlooks. Consumer sentiment indices, wage growth trends, and retail sales data will help gauge the strength and durability of demand. In the labor market, the balance between initial and continuing claims will continue to illuminate the trajectory of employment conditions and potential spillovers into consumer spending. On the macro front, energy prices and inflation metrics will shape both monetary policy expectations and corporate strategy, particularly for consumer-facing firms. Finally, technical signals from major indices will guide tactical allocation decisions, especially in terms of hedging and cash management.

Conclusion

The week’s developments across earnings, markets, labor data, and global narratives collectively point to a cautious but data-driven path forward. The earnings disappointments or softer outcomes from McDonald’s and Starbucks illuminate how inflation, tariffs, and evolving consumer sentiment are translating into real-world buying patterns, especially among lower-income households most exposed to costs. The market backdrop—characterized by a mixed tape of buoyant near-term momentum but a clear risk of renewed volatility—calls for disciplined risk management, balanced exposure, and a readiness to adjust positions as moving-average dynamics and macro signals evolve. Labor-market signals reinforce the sense that the economy remains resilient yet not uniformly robust, signaling that hiring strength could waver in the months ahead. Finally, the narrative around gold and China’s possible asset moves serves as a reminder that global capital flows and currency dynamics are complex, often evolving gradually rather than through abrupt shifts.

In this environment, investors and strategists should prioritize clarity of the macro picture, discipline in portfolio construction, and a vigilant stance toward developments in consumer behavior and policy. The road ahead likely involves a careful dance between hedged positioning and opportunistic exposure, with an emphasis on preserving capital during uncertain times while staying prepared to capitalize on the eventual return of stronger consumption, easing inflation, or policy clarity. The overarching takeaway is simple: inflation and uncertainty continue to shape the pace and texture of both corporate performance and market outcomes, and success will hinge on navigating these forces with rigor, resilience, and a long-term perspective.