WhatsApp Expands Payment Options in India, Partners with PayU and Razorpay

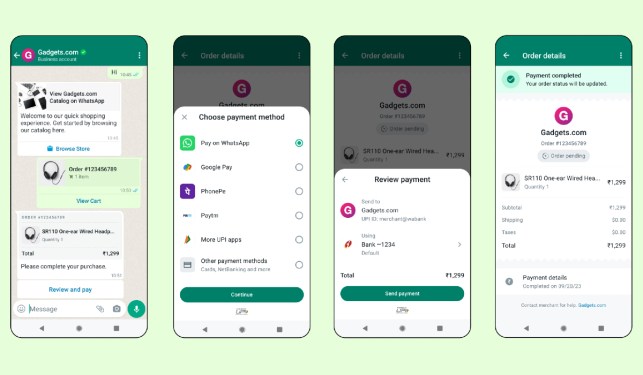

In a move aimed at enhancing the user experience and increasing revenue, WhatsApp is rolling out a new feature that will allow its users in India to pay businesses using various payment options from within the instant messaging app. This development comes as part of the Meta-owned app’s continued efforts to expand its e-commerce offerings.

A Partnership with PayU and Razorpay

WhatsApp has partnered with two prominent payment processors, PayU and Bengaluru-headquartered Razorpay, to add support for payments via credit and debit cards, net banking, and all UPI apps in India. This move follows WhatsApp’s partnership with Stripe earlier this year to enable payments through the app in Singapore.

Increased Payment Options

The new feature will allow businesses using the WhatsApp Business platform to receive payments from customers using a variety of payment options. This is expected to make it easier for people to pay Indian businesses within a WhatsApp chat, using whatever method they prefer.

According to Mark Zuckerberg, founder and CEO of Meta, "This is going to make it even easier for people to pay Indian businesses within a WhatsApp chat using whatever method they prefer."

Availability and Impact

The payment feature is available to all businesses in India using the WhatsApp Business platform. With over 500 million users online on WhatsApp in India, the South Asian market is Meta’s largest globally.

This move is expected to have a significant impact on the e-commerce industry in India, where the likes of Google Pay, Walmart-owned PhonePe, and Indian fintech giant Paytm dominate the UPI ecosystem. However, with this update, both customers and businesses will be able to use WhatsApp as a commerce solution, broadening its scope.

Enhanced Customer Experience

The latest update eases customer experience by bringing third-party payment options for merchants selling products through the app. This is in addition to the existing UPI-based WhatsApp Pay feature that Indian businesses could previously use to receive payments from customers.

Indian conglomerate Reliance Industries utilized this support to offer an end-to-end shopping experience on WhatsApp through its JioMart bot last year. However, with the new update, more businesses will be able to take advantage of this feature.

Boosting Revenue

The enhanced payment support is expected to boost revenue for WhatsApp as more users shop via the platform. This is especially relevant given that WhatsApp Business has been a crucial source of revenue for the app, which does not charge users directly through subscriptions and has no plans to serve ads in chats.

Earlier this year, the app introduced paid features for automation and custom merchant messages. With enhanced payment support, more businesses will be able to offer their products and services through the platform, increasing the potential for revenue growth.

In-App Shopping Experience

WhatsApp is also improving its in-app shopping experience through a feature called Flows, which will allow users to complete tasks such as picking a seat on a flight or booking an appointment directly from the messaging app. This is part of the app’s ongoing efforts to enhance its e-commerce offerings and provide a richer user experience.

Conclusion

The new payment feature in WhatsApp will undoubtedly have a significant impact on the e-commerce industry in India. With over 500 million users online on WhatsApp, the South Asian market presents a vast opportunity for businesses to reach customers through the app.

By partnering with PayU and Razorpay, WhatsApp has expanded its payment options, making it easier for people to pay Indian businesses within a WhatsApp chat using whatever method they prefer. This move is expected to boost revenue for the app as more users shop via the platform, and will undoubtedly have far-reaching consequences for the e-commerce industry in India.

Related Topics

Sources:

- PayU

- Razorpay